According to Shearman & Sterling LLP on March 25, 2021, Senators Bernie Sanders (VT) and Sheldon Whitehouse (RI) introduced the For the 99.5% Act (the “Act”), which proposes major changes to the U.S. transfer tax regime by increasing estate, gift and generation-skipping transfer (GST) taxes and vitiating the effectiveness of certain wealth transfer planning techniques.

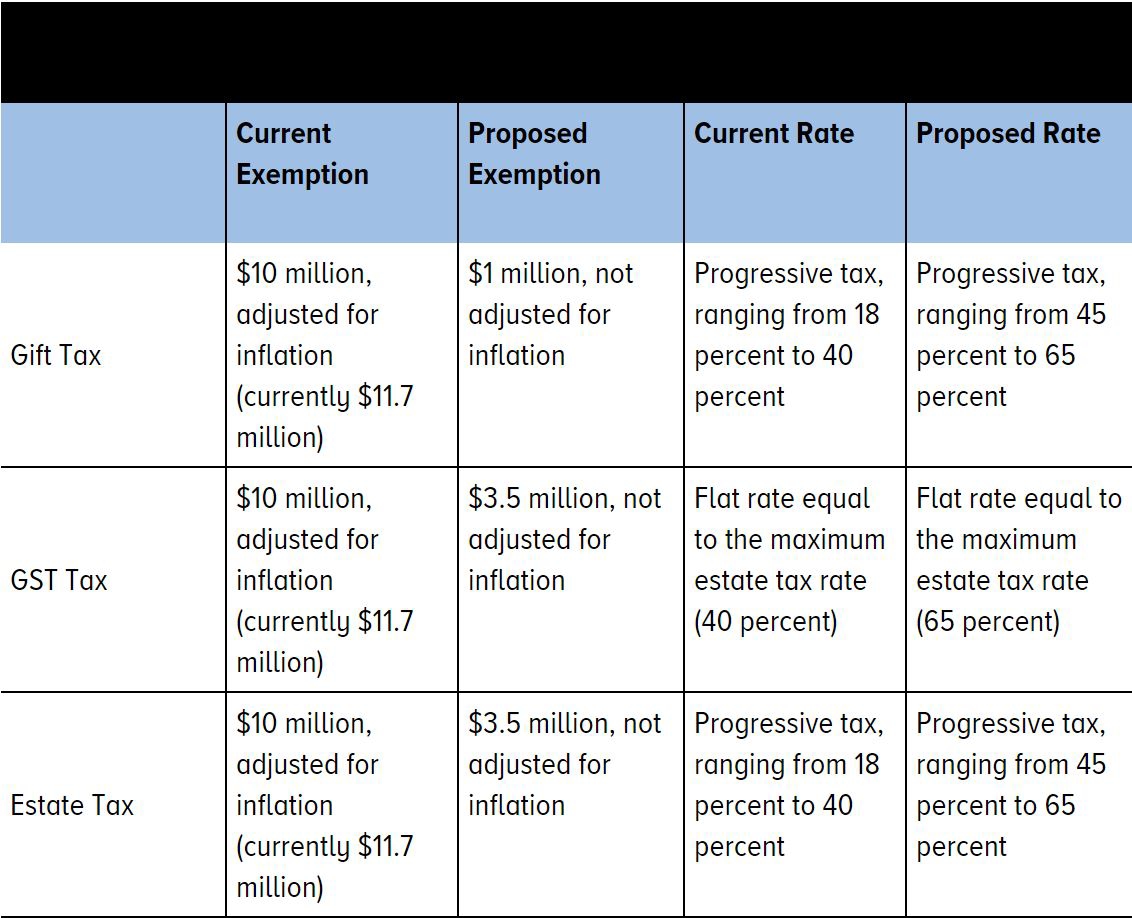

The chart below highlights the proposed substantial reductions in estate, gift and GST exemption amounts and increases in transfer tax rates for gifts made, and estates of decedents dying, after December 31, 2021:

Annual Exclusion Gifts: Annual exclusion gifts would no longer be unlimited. A donor could not give more than twice the annual exclusion amount (currently $15,000) if the gift is of an asset that cannot be immediately liquidated by the recipient, such as gifts in trust or gifts of entity interests. Withdrawal or put rights would be disregarded for this purpose. Other proposed changes would affect transfers made, and trusts created, after the enactment date of the Act. These changes include:

It is unclear which, if any, of these provisions will be enacted into law and—other than the proposed reductions in exemption amounts and increases in tax rates which become effective on January 1, 2022—what the effective date would be.

- Grantor Trusts: Assets that are transferred by a decedent to a grantor trust after the enactment date would generally no longer avoid estate tax, and distributions made from a grantor trust would be subject to gift tax. A grantor trust created and funded prior to the enactment date would generally be exempt from these provisions to the extent no additional contributions were made after the enactment date.

- GRATs: Grantor-Retained Annuity Trusts (GRATs) would be less effective in transferring wealth as they would be required to have: (i) a minimum term of 10 years, (ii) a maximum term of the grantor’s life expectancy plus 10 years and (iii) a remainder interest of not less than the greater of 25 percent of the fair market value of trust assets and $500,000.

- GST Exempt Trusts: For a trust distribution to qualify for GST exemption, the trust could no longer have a term of more than 50 years. Existing GST exempt trusts lasting more than 50 years would lose their GST exempt status 50 years after enactment.

- Valuations: The availability of marketability and minority discounts for appraisals of interests held in entities would be severely limited.

- Basis Step-Up: The Act would confirm that a step-up in basis is not available to assets held in a grantor trust unless those assets are includable in the grantor’s estate, which is something most practitioners have already accepted. A separate bill, known as the Sensible Taxation and Equity Promotion (STEP) Act, was also recently introduced with the purpose of effectively eliminating any step-up in basis at death.

It is unclear which, if any, of these provisions will be enacted into law and—other than the proposed reductions in exemption amounts and increases in tax rates which become effective on January 1, 2022—what the effective date would be.

What is clear, is that the Act is intended to substantially increase the transfer tax burden on high-net-worth families.

By Engaging In Proactive Planning Now, However, You Can Still Take Advantage Of The Current Law,

Which Is Considerably More Favorable.

Which Is Considerably More Favorable.

Due to the introduction of the Act, we encourage you to revisit your estate plan to ensure that it continues to reflect your wishes and that you consider if you should take advantage of certain effective wealth transfer planning techniques while they are still available.

Want To Cut Your Estate Tax?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact us at

or Toll Free at 888-8TaxAid (888 882-9243).

No comments:

Post a Comment