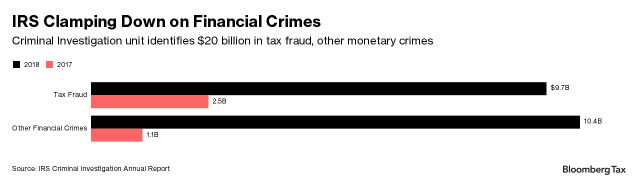

In its IRS Criminal Investigation Annual Report for 2019 the IRS Criminal Investigation division found nearly $10 billion in tax fraud in fiscal year 2018, four times more than last year thanks to its focus on using data analytics.

Bloomberg BNA reports that Don Fort, chief of the Criminal Investigation division, said in a statement “We prioritized the use of data in our investigations in fiscal 2018.” “The future for CI must involve leveraging the vast amount of data we have to help drive case selection and make us more efficient in the critical work that we do. Data analytics is a powerful tool for identifying areas of tax non-compliance.”

The number of special agents working on the CI team fell below 2,100 by the end of the unit’s 2018 fiscal year because of retirements and hiring freezes, leading CI to look at everything from bank records to the dark web to help investigate cases, according to the statement.

The figures are also a testament to the Department of Justice’s crackdown on U.S. taxpayers hiding money in Swiss banks, because a “huge amount of money” is now entering the system, said Neiman, who worked at the DOJ’s tax and criminal divisions and in investigations into Switzerland’s largest bank, UBS Group AG.

But the combined $20 million discovered in fiscal 2018 is “just the tip of the iceberg,” according to Betty J. Williams, managing shareholder of Law Office of Williams & Associates, P.C. in Sacramento, Calif.

“Just As Quickly as Criminals Become More Crafty in the Way They Commit Crimes, The Criminal Investigation Division is Trying To Keep Up With How To Detect Those Crimes.

And While They’re Catching More Criminals,

There Are More Criminals To Catch,” said Williams

The evolution of financial crime mirrors the evolution of money movement in general, said CI Chief, Don Fort. Criminals stay current with the trends and adopt their methods to match the public’s tendencies.

The Speed At Which Money Moves Today Is Almost Instantaneous And The Convenience That Comes With That Opens The Door For Criminals To Exploit The Latest Technological Advancements.

Years ago, we had time on our side and we could allow things to play out without losing a trace of a criminal or their proceeds. Now, money disappears in the blink of an eye.

All that is needed is a smartphone to move money from one location to another, anywhere in the world. The internet and the dark web have facilitated this change and law enforcement has had to make adjustments to keep up.

CI has made significant investments in training our new employees and experienced employees and this investment is unmatched within the IRS. We instituted Master Your Craft training for special agents while introducing new specialized training for our professional staff as well. You can expect these investments to continue.

No comments:

Post a Comment