UK Leads the Outflow: The “WEXIT” Phenomenon

For the first time in a decade, the UK is set to top the

global leaderboard for millionaire outflows, with a staggering net loss of

16,500 HNWIs in 2025, more than double the outflow from China, which had

dominated this ranking for years. This

dramatic shift is being driven by recent tax reforms, including sharp hikes in

capital gains and inheritance taxes, as well as new rules targeting

non-domiciled residents and family wealth structures. The result? A mass exodus

of wealthy individuals seeking more favorable environments, a trend some are

calling “WEXIT” (wealth exit).

Europe’s Wealth Hubs: Retreat and Reinvention

The UK isn’t alone. Major EU economies France (–800), Spain

(–500), and Germany (–400) are also forecast to see net millionaire losses in

2025. Even smaller markets like Ireland, Norway, and Sweden are experiencing

significant outflows. The

reasons are multifaceted, including tax pressures, political uncertainty, and a

search for better investment climates.

But not all of Europe is losing out. Southern Europe is

emerging as a new center of gravity for wealth migration:

·

Switzerland: +3,000

net inflow

·

Italy: +3,600

net inflow

·

Portugal: +1,400

net inflow

·

Greece: +1,200

net inflow

·

Monaco: +200

net inflow

Favorable tax regimes, lifestyle appeal, and active

investment migration programs are drawing the wealthy southward, with cities

like Milan, Lisbon, and the Athenian Riviera becoming new hotspots.

Global Winners: Where the Wealth Is Heading

The UAE retains

its crown as the world’s leading wealth magnet, expecting a record net inflow

of 9,800 millionaires in 2025, well ahead of the US (+7,500).

The UAE’s appeal is bolstered by attractive golden visa options and its status

as a stable, business-friendly hub for global investors, especially from the

UK, India, Russia, Southeast Asia, and Africa.

Other notable destinations include:

·

Saudi Arabia: +2,400

(biggest riser, driven by returning nationals and international investors)

·

Singapore: +1,600

(though net inflows are at their lowest on record)

·

Australia & Canada: +1,000 each (also seeing reduced appeal)

·

Thailand: +450

(emerging as Southeast Asia’s new safe haven)

·

Hong Kong: +800

(steady inflows from Asia’s tech sector)

·

Japan: +600

(influx from China due to stability)

Caribbean and Central American countries—like Costa Rica,

Panama, the Cayman Islands, and Bermuda—are also attracting record numbers of

wealthy migrants, as are African nations such as Morocco, Mauritius, and

Seychelles.

Global Losers: Where the Wealth Is Leaving

Beyond the UK, significant outflows are expected from:

·

China: –7,800

(lowest net loss since Covid, with more affluent Chinese choosing to stay)

·

India: –3,500

(offset by some returnees from the UK)

·

South Korea: –2,400

(political and economic turbulence)

·

Brazil: –1,200

(wealth drains to the US, Portugal, and the Caribbean)

·

Russia: –1,500

·

Vietnam: –300

·

Lebanon, Iran, Israel: Modest but concerning losses, often to Cyprus, Greece, and the

UAE[1]

The Big Picture: What Does It All Mean?

Millionaire migration is more than a trend—it’s a barometer

of global confidence, policy effectiveness, and the shifting sands of economic

opportunity. The fastest-growing wealth markets are often those that attract

migrating millionaires or are emerging tech hubs, highlighting the crucial role

of mobility in wealth creation.

As 2025 unfolds, the global map of wealth is being redrawn, one millionaire at a time.

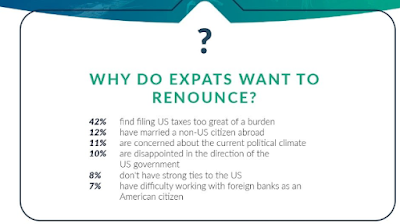

- Nearly 1 in 4 American expatriates say they are “seriously considering” or “planning” to ditch their U.S. citizenship, a survey from Greenback Expat Tax Services finds.

- About 9 million U.S. citizens are living abroad, the U.S. Department of State estimates.

- More than 4 in 10 who would renounce citizenship say it’s due to the burden of filing U.S. taxes, the Greenback poll shows.

or Toll Free at 888-8TaxAid (888) 882-9243

No comments:

Post a Comment